GET STRAIGHT ANSWERS

AND A GREAT DEAL

AND A GREAT DEAL

from an independent mortgage company with a 5 star record of success

from an independent mortgage company

with a 5 star record of success

We Take On Your Mortgage Challenge

When you buy a car, you might ask a trusted mechanic to check it out before you buy. Or if you’re learning to scuba dive, you probably won’t just jump into the ocean without a trainer by your side. Buying a home or a commercial property is likely one of the biggest investments you’ll ever make! It makes sense to have someone on board to guide you through the loan process that can have lasting impact on your financial future.

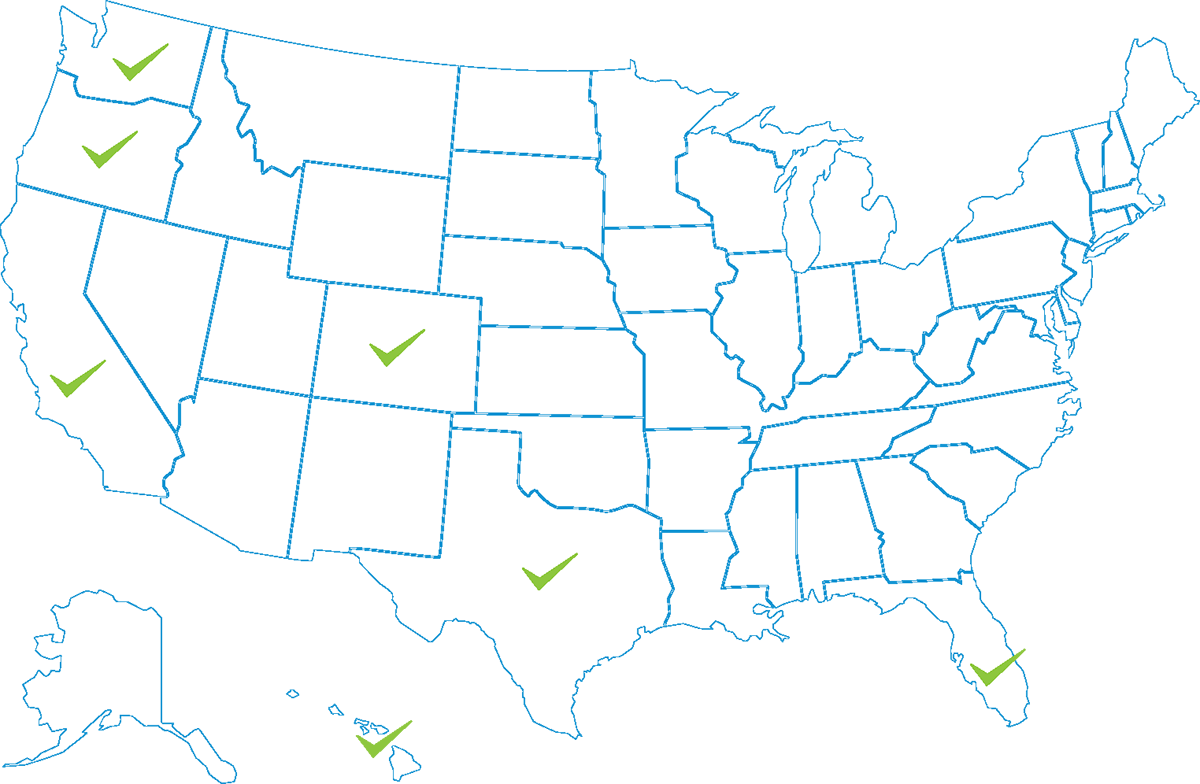

At Straight Deal Mortgage we’re your mortgage loan guardian, with a fiduciary responsibility to do what benefits you most. We’re determined to get through the maze of mortgage lending and come out on the other side with the absolute best solution for you.

When you buy a car, you might ask a trusted mechanic to check it out before you buy. Or if you’re learning to scuba dive, you probably won’t just jump into the ocean without a trainer by your side. Buying a home or a commercial property is likely one of the biggest investments you’ll ever make! It makes sense to have someone on board to guide you through the loan process that can have lasting impact on your financial future.

Here’s how we can help

There’s a strategy to getting a great deal and we’ve got the key

We are driven by experience, empathy, and a hunter-gatherer mindset to beat the mortgage lending machine to find you the best deal possible. With over 27 years in the mortgage industry, we are experts in navigating the lending guidelines that make no common sense. Our job is to help the bank’s underwriter make the right decision for you by structuring your application to get the loan approved. The loan approval is a YES to you getting your mortgage!

280 unfiltered reviews tell the Straight Deal Mortgage story!

“Vic got us through a complicated deal. Although we encountered several unexpected hurdles along the way, we still ended up closing a day early with a good deal on the mortgage thanks to Vic’s diligence. Vic’s knowledge, expertise and attention to communication kept our stress level down throughout the process.”

“Vic and his office are amazing. They are easy to work with, professional, honest, communicative, and are not in it for themselves. You can count on his advice being in YOUR best interest, and you can count on things going smoothly. Highly recommend. I have used him multiple times for everything from purchases, to HELOANS, to REFIs, and he is the only person I would use in the future. 100% recommend.”

“Vic was wonderful & incredibly helpful from start to finish during our home buying process. He was so knowledgeable & put us as a priority each day. He was quick to answer any and all of our questions and explain transaction steps in an understandable way. He gets a 10/10 and we will use him again for our next home purchase!”

Get on the Right Track to a Good Financial Decision

WE CAN CLOSE FASTER AND MORE EFFICIENTLY THAN THE LARGE BANKS CAN!

Here’s how to get started in the right direction.

STEP 1

Schedule a free Mortgage 101 consultation here

STEP 2

Gather up the supporting documents you’ll need

for your loan application

STEP 3

Complete a no-obligation online loan application to receive personalized information about your options